Donation Receipt Template

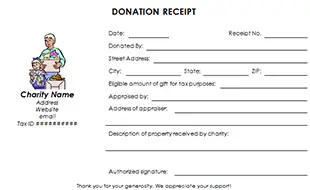

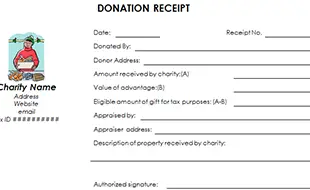

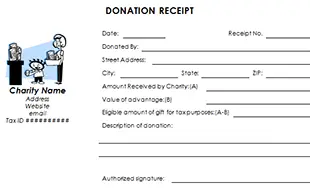

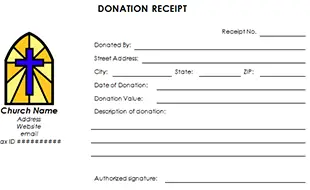

If you are looking for an easy way to create donation receipts for your charity organization, you will find it here in this section.

A donation receipt records the contributions that a donor made on a specific date. If you are in charge of creating donation receipts for your organization, using the donation receipt template in this section is an excellent start.

Information on donation receipt

The donation receipt templates are fully customizable. When you design your own receipt based on our templates, you should include the following information in the receipt:

- Information about the organization including logo, name, address, tax identification number and a statement showing that the organization is a registered 501(c)(3) organization.

- Information about the contribution including date of the contribution, donor’s name, type of contribution e.g., cash, goods or service, and value of the contribution.

- The name and signature of the authorized representative of the organization should be also included in the donation receipt.

If there is anything that the donor receives in exchange for the contribution, it should be noted in the donation receipt as well.

Time-saving tips for creating donation receipts

To create donation receipts quickly:

- First, choose one of the following donation receipt templates that suits your organization’s style most and download it.

- Second, add the basic information such as logo, organization name, address, etc., to the donation receipt and save it as you template so that in the subsequent uses, you don’t have to fill out those information again.

- Third, create a new receipt from the template, add the contribution’s information, and print it out for getting the authorized representative’s signature.

The donation receipt is often sent to the donor along with a thank you letter. You should not combine the thank-you letter to the donor with a donation receipt because the donor may want to show the thank-you letter while keeping the contribution confidential.

Importance of the donation receipts

Donation receipts are important to not only the charity organization but also to the donor. For the donor, donation receipts are used for tax deductions when filling taxes. And for the organization, they are used as records of contributions.

Receipt Template Professional Receipt Templates for Businesses and Individuals

Receipt Template Professional Receipt Templates for Businesses and Individuals