If you are managing a charity organization, you must deal with creating tax-deductible donation receipts regularly.

We provide a tax-deductible donation receipt template to help you create tax-deductible donation receipts quickly and easily. The receipt template is a Microsoft Word document so you can customize it and make it work for your organization. With this tax-deductible donation receipt template, you can:

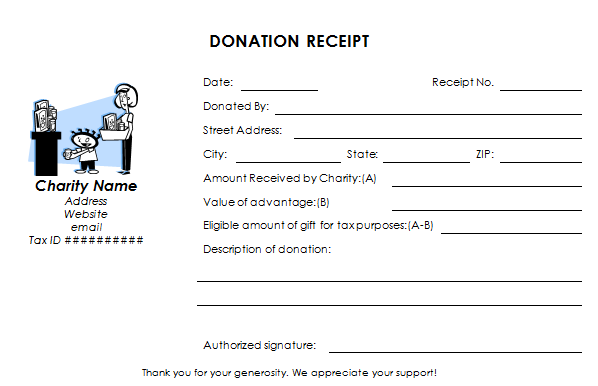

- Add your organization logo and name.

- Insert your organization address with contact details, including email and website.

- Put your organization’s tax ID number.

The tax-deductible donation receipt template provides basic information so that you only have to fill out the necessary information as follows:

- Date when the receipt was issued and receipt number.

- Donor’s information, including name and address details.

- An eligible amount of gift for tax purposes is equivalent to the amount received minus the value of advantage. This donation receipt assumes that the donor receives something in return for the gift, e.g., a meal and a book.

- The authorized signature of your organization

Tips for saving time creating tax-deductible donation receipts

To save time creating tax-deductible donation receipts, you can follow the steps below:

- Download the tax-deductible donation receipt template.

- Add the organization’s information and other additional information if needed.

- Save the document as a new template and use it for creating tax-deductible donation receipts. This helps you save time filling out the same information on your organization each time you create the donation receipts.

Download the tax-deductible donation receipt template

Start downloading the tax-deductible donation receipt template to create tax-deductible donation receipts for your donors. You can print two copies of a receipt per letter or A4 paper. Keep one copy for yourself and send a copy to the donor and a thank you letter.